Intangible assets are non-physical resources and rights that have a value to the firm because they give the firm some kind of advantage in the market place.Current assets include inventory, while fixed assets include such items as buildings and equipment. For example, an increasing debt-to-asset ratio may indicate that a company is overburdened with debt. Determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. Tangible assets contain various sub classes, including current assets and fixed assets. Analysis of financial ratios serves two main purposes: 1.Two major asset classes are tangible assets and intangible assets. It is money and other valuables belonging to an individual or business. The balance sheet of a firm records the monetary value of the assets owned by the firm. The ROCE and Operating profit margin ratios are often considered in conjunction with the asset turnover ratio. Retailers generally have high asset turnovers accompanied by low margins. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). Commonly a high asset turnover is accompanied with a low return on sales and vice versa. Anything tangible or intangible that is capable of being owned or controlled to produce value, and that is held to have positive economic value, is considered an asset. The asset turnover ratio tries to build a relationship between the companys revenue and the companys overall assets. In financial accounting, assets are economic resources.

#Assets turnover ratio professional

Sales are the unique transactions that occur in professional selling or during marketing initiatives. In financial ratios that use income statement sales values, "sales" refers to net sales, not gross sales.Also referred to as revenue, they are reported directly on the income statement as Sales or Net sales. In bookkeeping, accounting, and finance, Net sales are operating revenues earned by a company for selling its products or rendering its services.It is calculated by adding up the assets at the beginning of the period and the assets at the end of the period, then dividing that number by two. Average Total Assets" is the average of the values of "Total assets" from the company's balance sheet in the beginning and the end of the fiscal period.

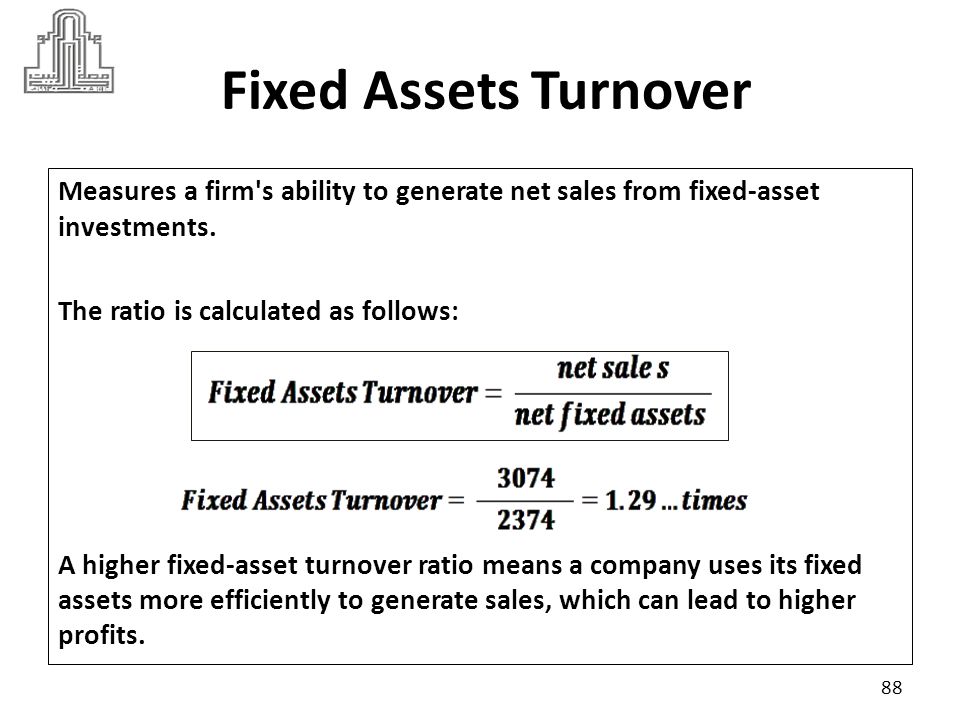

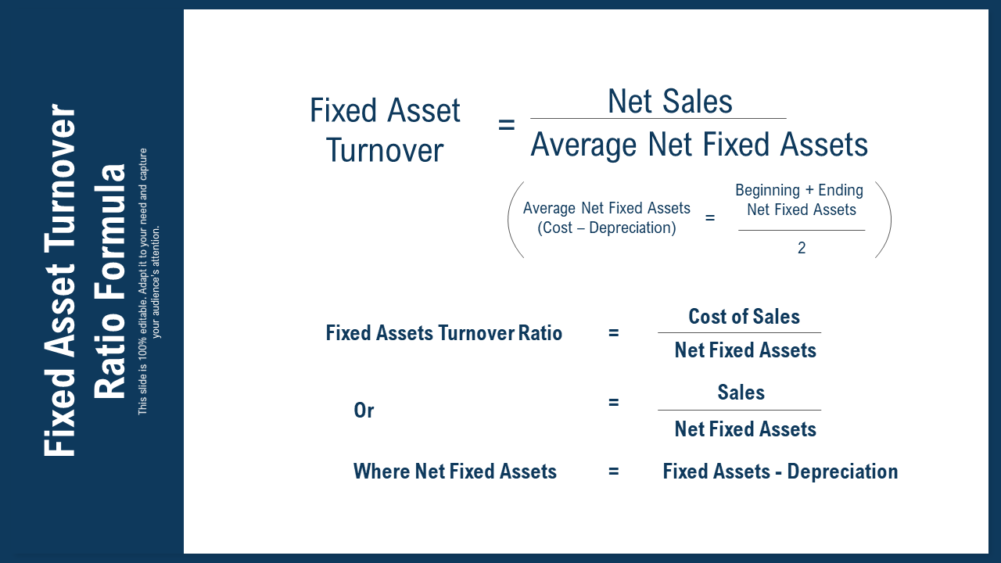

We can now calculate the fixed asset turnover ratio by dividing the net revenue for the year by the average fixed asset balance, which is equal to the sum of the current and prior period balance divided by two. "Sales" is the value of "Net Sales" or "Sales" from the company's income statement". Fixed Asset Turnover Calculation Example.Total assets turnover = Net sales revenue / Average total assets

Companies in the retail industry tend to have a very high turnover ratio due mainly to cut-throat and competitive pricing.

Asset turnover measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company.Ĭompanies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover.

0 kommentar(er)

0 kommentar(er)